Coaching 5th Grade Basketball Taught Me a Few Things About The Market: A 2025 Recap- And The 2026 Playbook

This winter, I’m coaching my son’s 5th-grade basketball team.

If you’ve ever coached kids at that age, you know the drill:

- Everyone wants to shoot

- Everyone thinks they’re open

- And everyone believes the best strategy is to go faster

Somewhere between teaching spacing, preaching defense, and explaining (again) why passing matters, it hit me:

This is exactly what investing felt like in 2025.

Fast pace.

Lots of scoring.

Some incredible highlights.

And just enough mistakes to remind you that fundamentals still win championships.

The 2025 Season: The Scoreboard Looked Great — But the Film Matters More

From a distance, 2025 looks like a blowout win.

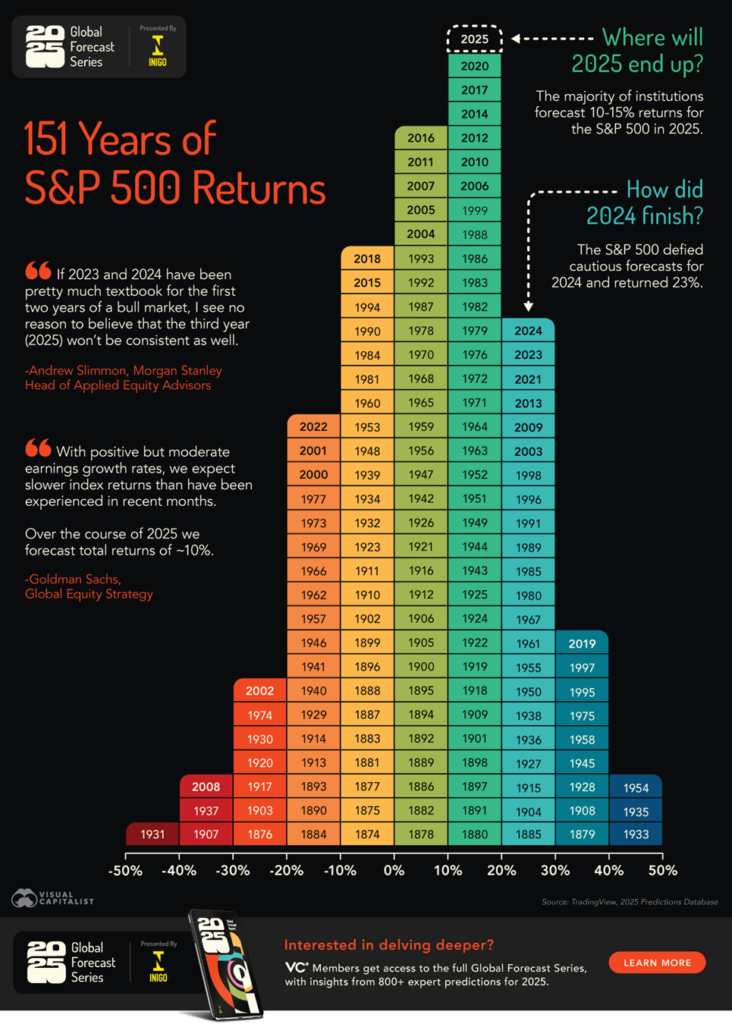

The S&P 500 finished the year up, driven largely by U.S. large-cap growth stocks and continued momentum in artificial intelligence. That’s a great season by almost any historical standard.

But if you’ve coached — or invested — long enough, you know the scoreboard only tells part of the story.

Some teams win because the other side makes mistakes.

Others win because they execute better.

2025 Was An Execution Year.

Chart context:

U.S. equity markets delivered strong returns in 2025, extending a multi-year run of above-average performance.

Source:

Charles Schwab — Stock Market Outlook

https://www.schwab.com/learn/story/stock-market-outlook

The Rest of The Story:

Returns were driven by earnings growth, capital spending, and leadership, not cheap money or speculation alone.

AI in 2025: This Wasn’t a Hot Streak — It Was the Weight Room

One thing I tell my players all the time is:

“Games aren’t won on game day. They’re won in practice.”

That same principle applied to AI in 2025.

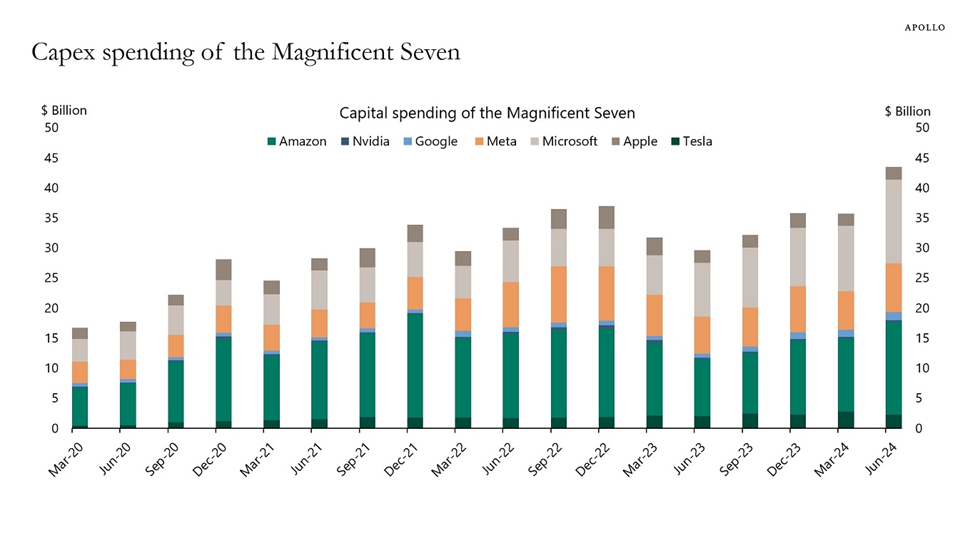

Behind the scenes, companies weren’t just talking about innovation — they were spending real money to build it.

BlackRock estimates that the global AI buildout could require $5–8 trillion in capital investment through 2030, much of it front-loaded into data centers, compute power, semiconductors, and energy infrastructure.

Chart context:

The AI buildout represents one of the largest and fastest capital investment cycles in history.

Source:

BlackRock Investment Institute — 2026 Global Outlook

https://www.blackrock.com/institutions/en-us/insights/blackrock-investment-institute/global-outlook

Coaching Analogy:

This is the weight room. It’s not glamorous. It’s expensive. And it’s exactly why some teams get stronger while others fall behind.

Portfolios positioned around:

- AI infrastructure

- Industrials and electrification

- Capital-intensive enablers

weren’t chasing highlights — they were investing in conditioning.

Market Concentration: Sometimes the Best Players Really Are the Best Players

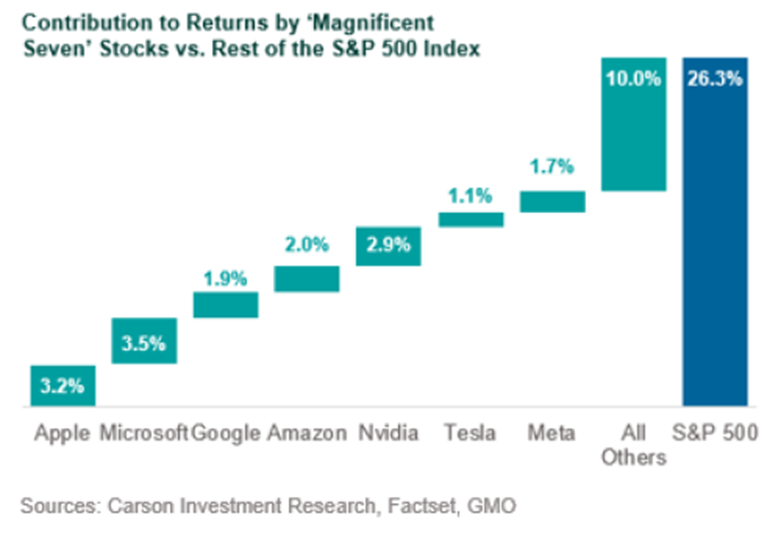

One of the loudest complaints in 2025 was market concentration.

“Too few stocks driving returns.”

“Everything depends on the same names.”

“This feels risky.”

I hear the same thing in the gym:

“Why does he get the ball again?”

Here’s the truth — in basketball and investing:

You don’t spread the ball evenly to be fair. You give it to the players who can score.

In 2025, leadership was narrow because economic leadership was narrow. A small group of companies:

- Invested the most

- Innovated the fastest

- Delivered the strongest earnings

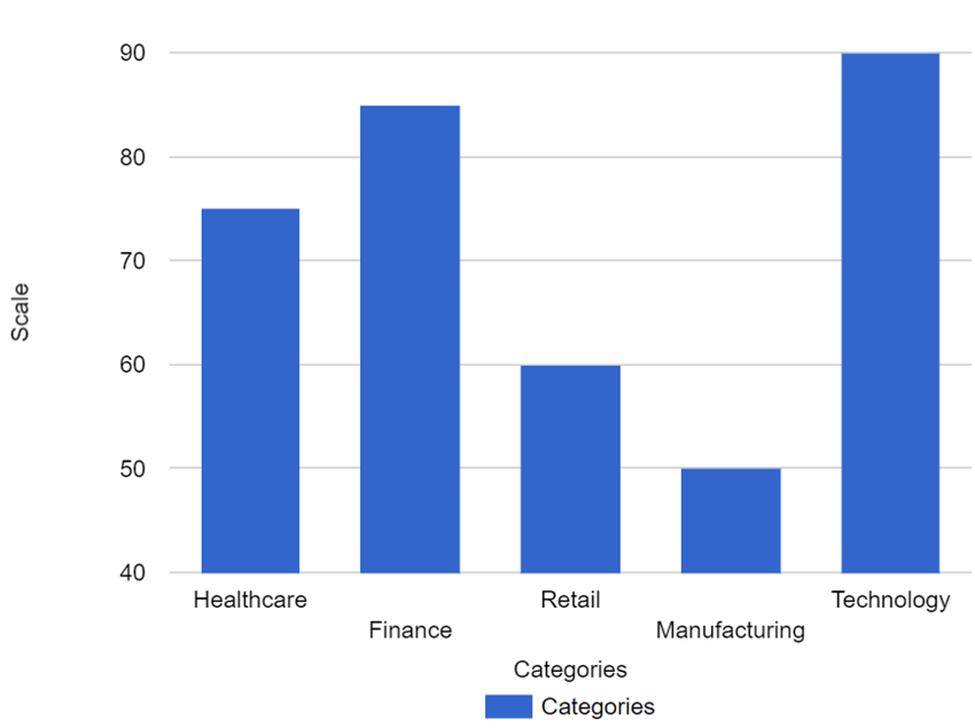

Chart context:

Market concentration reflected economic concentration, not speculation alone.

Source:

BlackRock Investment Institute — 2026 Global Outlook

https://www.blackrock.com/institutions/en-us/insights/blackrock-investment-institute/global-outlook

That doesn’t mean concentration lasts forever — but it does mean you play the season you’re in, not the one you wish you were in.

Halftime: Why 2025 Should Not Be the Expectation

After a big win, kids think the next game will be easier.

Coaches know better.

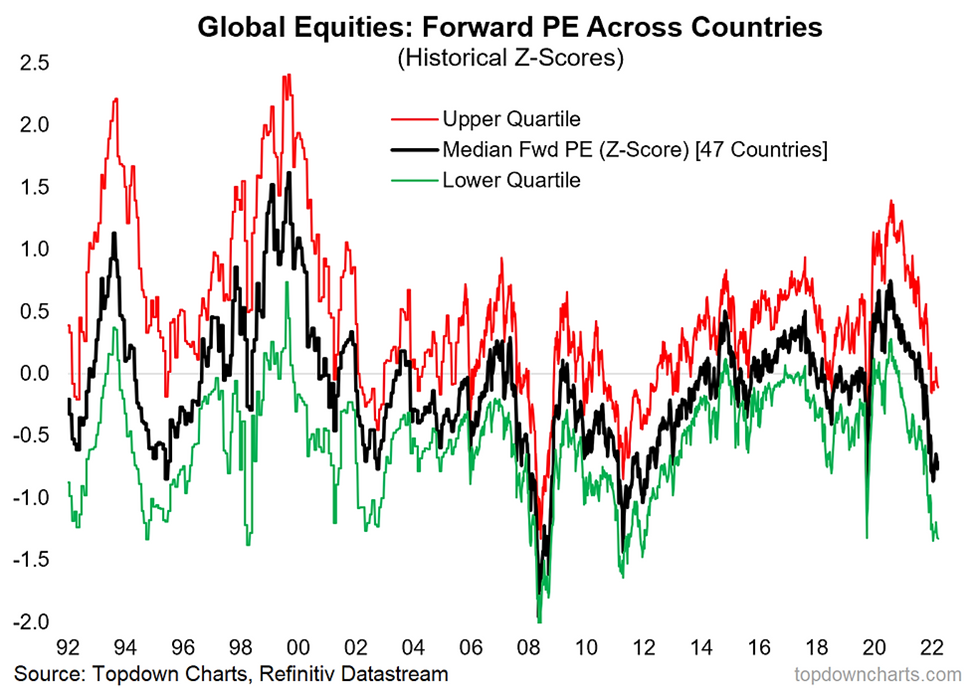

Capital Group’s 2026 Outlook reminds us that global equity valuations are now above long-term averages, which reduces the margin for error going forward.

Chart context:

Higher valuations increase sensitivity to disappointment and volatility.

Source:

Capital Group — 2026 Outlook

https://www.capitalgroup.com/individual/investments/2026-outlook.html

Historical context:

- ~10% corrections occur roughly every 16 months

- ~20% declines occur about once every six years

That’s not failure.

That’s the schedule.

The 2026 Environment: Fewer Fast Breaks, More Half-Court Offense

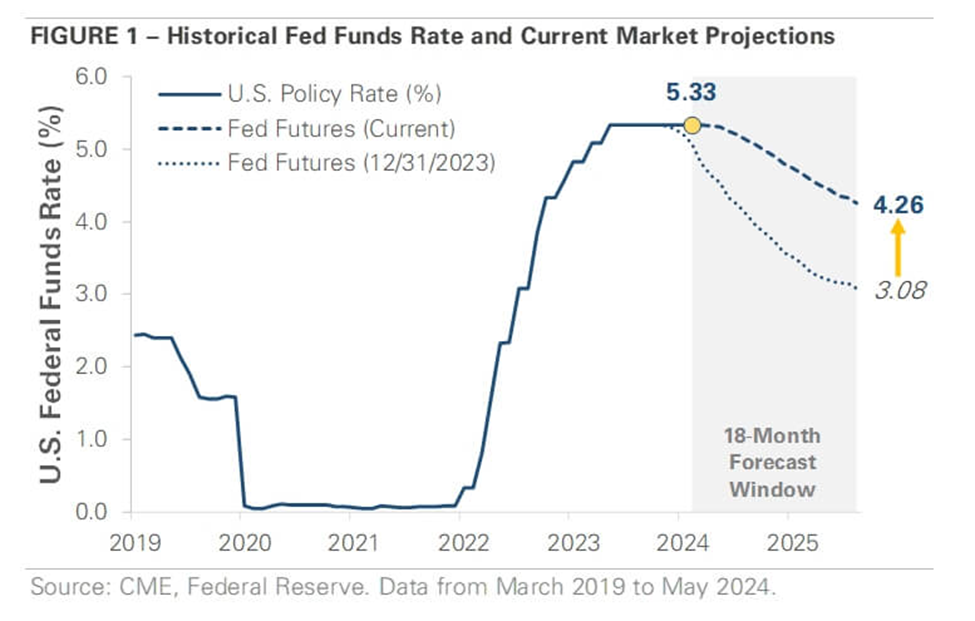

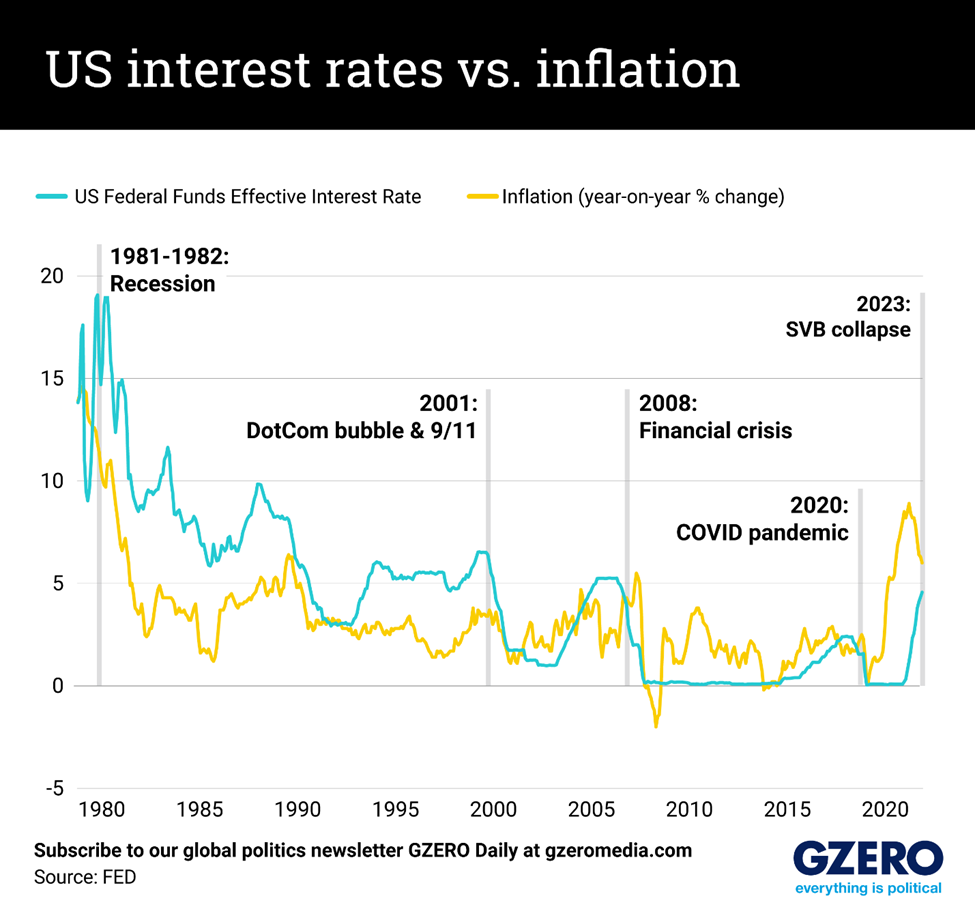

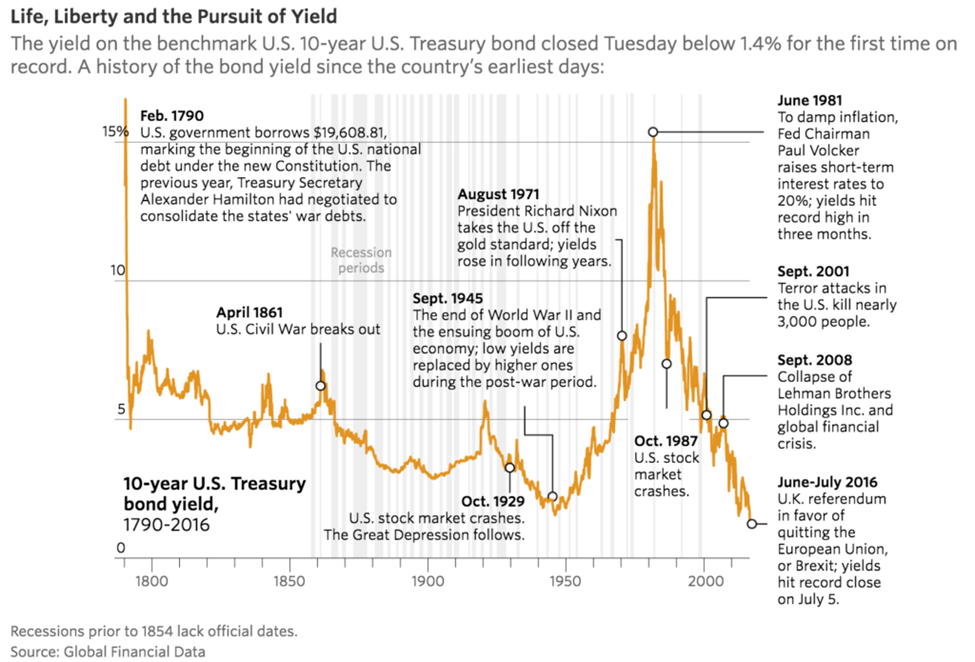

Most major research firms broadly agree on the setup for 2026:

- Economic growth moderates but remains positive

- Inflation cools but doesn’t disappear

- Interest rates trend lower, but don’t return to zero

In basketball terms:

The game slows down.

Defense tightens.

Execution matters more.

Chart context:

Lower rates can support markets, but the era of ultra-cheap capital is likely behind us.

Sources:

RSM US — Economic Outlook for 2026

https://rsmus.com/insights/economics/economic-outlook-for-2026.html

Charles Schwab — Stock Market Outlook

https://www.schwab.com/learn/story/stock-market-outlook

The 2026 Playbook: Adjusting the Offense and Tightening Defense

Every good coach keeps what works — and adjusts what doesn’t.

Adding New Plays: AI’s Second Act

In 2025, the market rewarded companies building AI.

In 2026, the opportunity may shift toward companies using AI to improve productivity, margins, and scale.

Source:

BlackRock Investment Institute — 2026 Global Outlook

https://www.blackrock.com/institutions/en-us/insights/blackrock-investment-institute/global-outlook

Coaching analogy:

This is motion offense. Scoring comes from more places, not just your star.

Quiet Winners: Industrials & Infrastructure

Capital Group and BNY Wealth both point to industrials and infrastructure as beneficiaries of:

- AI-driven capital spending

- Electrification

- Defense and reshoring initiatives

Sources:

Capital Group — 2026 Outlook

https://www.capitalgroup.com/individual/investments/2026-outlook.html

BNY Wealth — 2026 Outlook: Innovation Drives Opportunities

https://www.bnymellonwealth.com/insights/2026-outlook.html

Coaching analogy:

These are your rebounders and screen-setters. They don’t lead SportsCenter — but they win games.

Playing Better Defense: Quality, Cash Flow, and Bonds

As valuations rise, defense matters more.

That favors:

- Strong balance sheets

- Predictable cash flows

- And a renewed role for bonds

Sources:

BNY Wealth — 2026 Outlook

https://www.bnymellonwealth.com/insights/2026-outlook.html

Capital Group — 2026 Outlook

https://www.capitalgroup.com/individual/investments/2026-outlook.html

Coaching Analogy:

Bonds don’t score a lot — but they slow the game and protect leads.

Final Buzzer: Championships Are Won in the Details

Coaching 5th-graders reminds me daily:

Effort matters.

Talent matters.

But structure matters most.

The teams that improve year over year aren’t chasing highlights — they’re refining fundamentals.

That’s how we’re approaching 2026.

If this perspective resonates — and you know someone who could benefit from a thoughtful, fundamentals-driven approach — I’d be grateful for the introduction.

Because the best seasons aren’t remembered just for the score —

they’re remembered for how the team played.

This material is for informational purposes only and does not constitute investment advice. Past performance is not indicative of future results. All investing involves risk, including potential loss of principal

| Philip Lockwood | Founder + Managing Partner |

| Address | 1501 Ingersoll Ave. Suite 201 Des Moines, IA 50309 Phone | 515-274-8006 |

| Email | Plockwood@parklandrep.com Website | Lockwood Financial Strategies Securities offered through Parkland Securities, LLC, member FINRA (FINRA.org) and SIPC (SIPC.org). Investment Advisory services offered through SPC, a Registered Investment Advisor. Lockwood Financial Strategies, LLC is independent of Parkland Securities, LLC and SPC |